What does my retirement look like? (Part I)

Trying to work out 'how much is enough' when thinking about one’s retirement is a tricky question. However, you would not set off on a journey these days without punching a postcode into your SatNav device, so why would you not plan your route to a comfortable retirement also?

The starting point is to think about what you would like your retirement to look like, then think about what it would cost in today’s terms. If you are struggling with this, there is a handy benchmark provided by the Pensions and Lifetime Savings Association (PLSA) who have done a lot of work on retirement living standards.

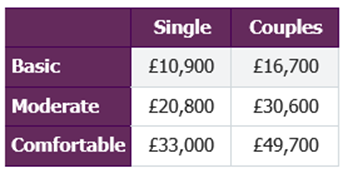

The PLSA have looked at the amount of money you would need in retirement for a ‘basic’ standard of living, a 'moderate' standard of living and a 'comfortable' retirement. You can find more details on their assessments by looking at their webpage. For each of these types of retirement, the PLSA have then worked out how much annual income you would need, providing separate figures for singles and couples. These are shown in the table below:

This does not, of course, account for differences in regional costs or personal perspective! Nor does it account for your own personal tastes, but it is a good starting point if you are floundering for figures. Another item it does not account for is long-term care, should you require it later in life, the cost of which can be considerable.

Another issue to cover when thinking about the money you spend in retirement is the differentiation between ‘essential’ expenditure, and ‘lifestyle’ expenditure. A view on this issue will differ from one household to another. However, we will always have bills to pay and weekly shopping to get. Some may consider the freedom owning and running a motor vehicle gives is ‘essential’? Whatever your views, it’s good to really think about where you spend your money each month, what you really will have to continue paying in retirement, and what might be expendable if your dream retirement might not be possible. Jotting this down will help crystalise your thoughts and will certainly be of use should you opt for help from a professional Financial Planner.

Now, if you think you are going to manage on a full Basic State Pension (BSP), then think again! According to Which?, for the 2022/23 tax year, the full BSP is set to rise to £185.15 per week, or £9,627.80 annually, not quite enough to cover a single person’s basic lifestyle on its own! That is, of course, if you have paid sufficient National Insurance (NI) contributions to earn the full pension. It is easy to get a State Pension Forecast via the Government Gateway website if you already have an account and, if you don’t already have an account, it is easy to set up. If you are not on course to get the full BSP, you may be able to improve your benefits by making up some NI contributions, this might be valuable given the triple lock guarantee presently.

Beyond the State Pension, you are now relying on employer or private pension schemes to make up the rest of your required income. You may be lucky enough to have some benefits in a ‘defined benefit’ pension from an employer, a type of workplace pension that pays you a retirement income based on your salary and the number of years you’ve worked for the employer, rather than the amount of money you’ve contributed to the pension. The scheme takes on the risk of funding the guaranteed pension, but the benefits that they promise to pay may be payable at an age later than you wish to retire. This may not be a problem if you have some funds in the other type of employer’s scheme, a ‘defined contribution’ or scheme, also known as ‘money purchase’ schemes. The benefits from these depend on how much you invest, how you invest, how much are taken off in charges, and how you decide to take the pension income at the other end. Whichever schemes you have, it pays to have an up-to-date statement from them so that you have an idea of the benefits you are due at the scheme retirement age, or the current fund value.

Having done this, you will have some information to hand regarding where you are now, and an idea of where you would like to be at retirement. The national Pensions Dashboard, when it arrives, will help individual savers keep track of their benefits, both personal and occupational – but don’t hold your breath, this one stop place for pension benefit information is still at the consultation stage!

The questions now are… can you make retirement work at the age you would like to, and if not, what can you do about it? Our advisers will try to provide some answers for this, and I will introduce the retirement equivalent of your SatNav device, in the second part of my blog on ‘What does retirement look like?’ – and if you can’t wait for that, perhaps you would like to contact Prosperis so one of our Financial Planners and get the ball rolling!